You’re getting ready to retire. Everything you’re reading right now is stating that it’s not a great time to be in bonds. They’re yielding very little; however, people who are about to retire typically want to have a little more security, and a little less volatility. You may, at this point, be wondering which direction to turn, since traditional market places are not providing you with an ideal investment vehicle.

The 4 Year Cash Strategy

A friend recently sent me an article advocating a strategy wherein a retiree removes 4 years’ worth of income from their portfolio and puts it into cash. During the following 4 years, the retiree spends from this cash, rather than drawing from their portfolio.

This strategy is based on the idea that, outside of the Great Depression, the market has always recovered within a 4-year period. So long as a retiree keeps their emotions in check, and only pays attention to the 4 years’ worth of income that they hold in cash, assets will recover from any downturn, and your retirement will remain on track right?

These sorts of ideas, while interesting, tend to come down to timing. People look at research such as this and believe it’s fairly easy to apply in real life, but that can be a problem in that this kind of research uses very long historical rates of return and standard deviations.

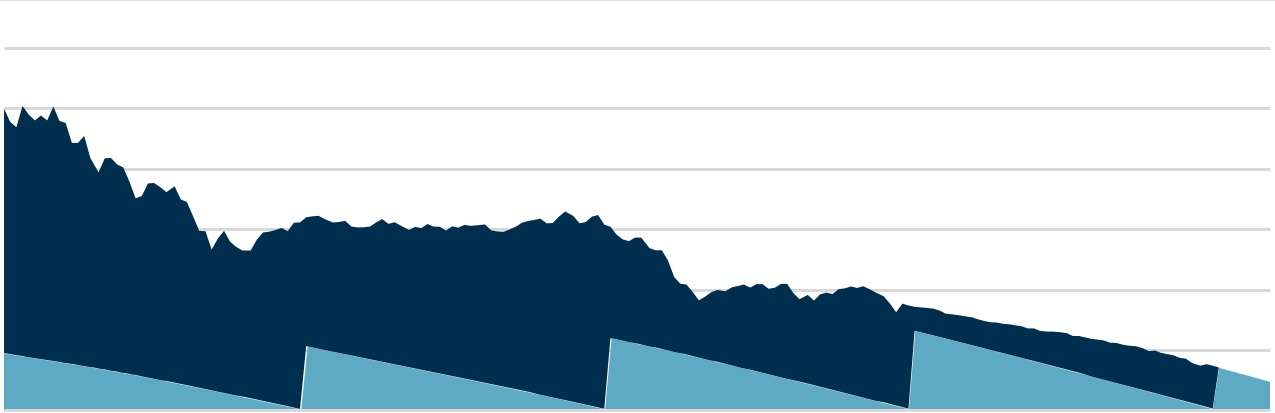

Let’s assume you are a retiree with a $1,000,000 portfolio. You want to take out $50,000 per year to live on, and that the rate of inflation is a fairly manageable 2%.

Let’s go backwards and have you retire in 1999, right before the bursting of the tech bubble.

You’ve set up your portfolio, you’ve taken out your $200,000 cash (4 years x $50,000), and you walk away to enjoy your retirement for the next 4 years. Your $800,000 remaining “invested” portfolio goes to work.

You come back 4 years later to find that the value of your portfolio, between what you’ve spent and the difficult market activity over that time frame, now stands at just $600,000.

Deciding to stay the course, you take out another 4 years’ of income, leaving a $400,000 portfolio to work while you enjoy your retirement.

The bottom line? As shown in the attached graph, after 16 years, or 4 cycles of this activity, you’ve almost entirely exhausted your portfolio.

Was the strategy a success? That depends on whether you were age 65 or age 82 when you put it in place.

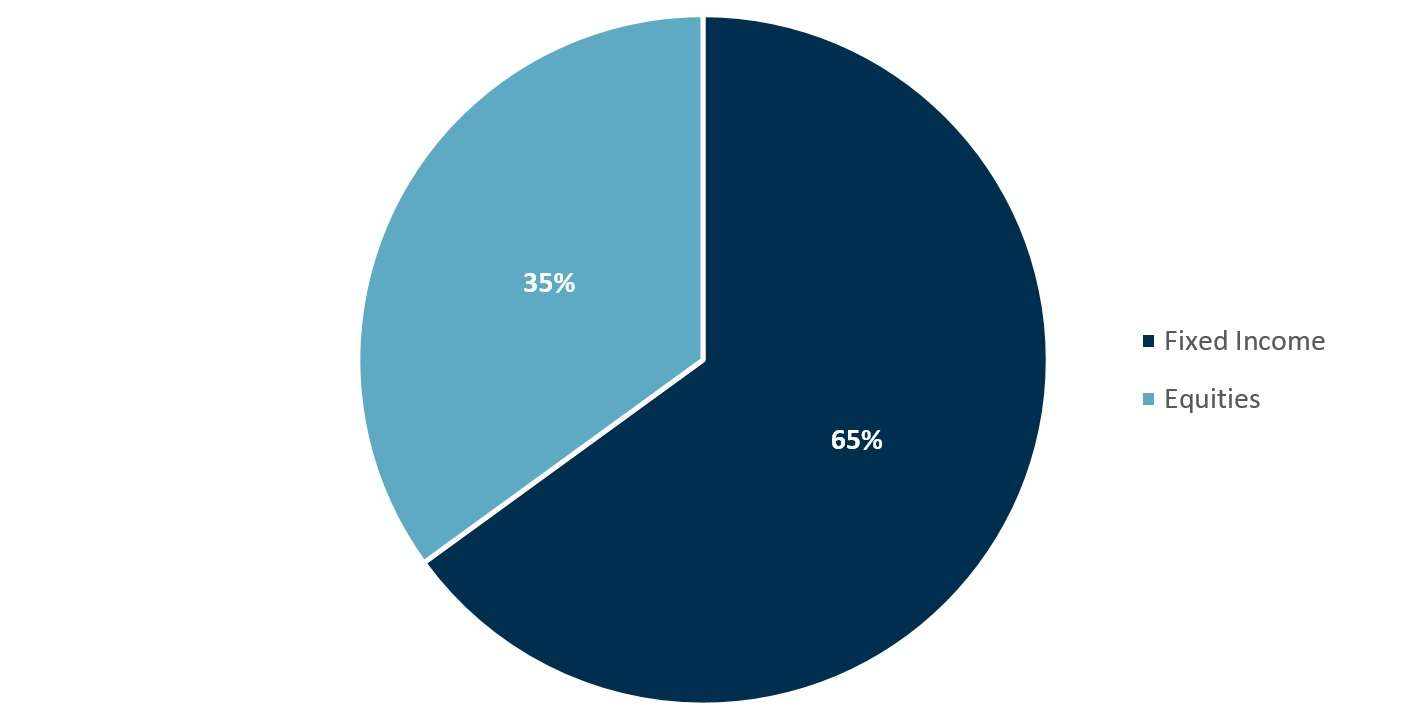

The 100 Minus Your Age Asset Allocation Strategy

Another common asset allocation strategy is to deduct your age from 100. The balance that is left over is invested in equities, while your age is invested in bonds and other fixed income investments.

For example, if you were 65 today, under this strategy your asset allocation would be:

Employing a strategy like this today could set up people for significantly lower performance than they’d been expecting – or worse, needing.

There’s a false sense of security around this portfolio structure that doesn’t really give credit to timing as an important factor, when you are deciding to live off of your investments.

You have to look at where we are today, and what we can count on, before making asset allocation and withdrawal strategy decisions. You can’t rely on a “rule of thumb” that was created with a different market environment as a backdrop.

Supply & Demand: Household Financial Assets

Just imagine for a minute that there are three people in a room. All three people have committed a certain amount of money to the market – all of their excess money.

If there are no other people left in the room, who is left to push the market higher?

The investment markets are no different than any other in that they respond to both supply and demand. If there is no one left to create demand – no more money flowing into the market – then how will prices be pushed higher? If prices are not pushed higher, then the value of the original investment these three people made into the market will not change.

We can monitor the commitment that regular people make to the market through a measurement of the Percentage of Household Assets currently invested in stocks.

Then, when you compare the percentage of household assets against the return in the market, a simple inverse relationship is uncovered.

As more people commit higher levels of their assets to the market, the opportunity for prices to rise decreases. As people drop out of the market, the opportunity for prices to rise increases.

By way of example, in 1983 27% of Household Financial Assets were committed to the market – one of the lowest ratios in the past 65 years. The subsequent rolling 10-year return in the S&P 500 was 18% per year.

Contrast this with the year 2000, when 62% of Household Financial Assets were committed to the market – one of the highest ratios over that same period. The subsequent rolling 10-year return in the S&P 500? -3%.

If you had retired in 1983 and used the 4 year cash strategy, you might be a very happy retiree. However, if you retired in 1999, like our retiree in the previous example, and used this strategy, you’d be decidedly less cheerful.

So, the next time someone misquotes Warren Buffet to tell you that you can’t “time” markets, reference the Oracle of Omaha accurately and let the uninformed investor know that while we may not be able to exactly time markets, we can, and certainly should, have a rough idea of their current value. This type of “timing” is, unfortunately, critical, and quite often people planning their retirement do not give it the justice it warrants.

What is in the control of the investor right now?

For the most part, this year has been one of those hated “rally” years – a most decidedly unloved year. No one expected the market to go up to the extent it has, and this has largely caught everyone off guard.

No one wants to miss out on rallies, and in the short run, there may be real opportunities to benefit, but you have to be cognizant going forward. You have to have a strategy that is aware of long term returns, understands what you need to protect, and has a game plan for what you will do when the market does eventually roll over.

Part of this is having other sources of return in your portfolio. If over time these alternative sources can generate 8-10% with a different return or risk portfolio than stocks or bonds, you may find that in the years when stocks are not doing particularly well, you are still on track.

Timing, of course, matters in any analysis. You need to focus your efforts more broadly. You need to understand the environment you are in, and what that means for you and your portfolio.

At Topturn, we are constantly seeking opportunities both in the traditional markets, but also outside, in areas where others aren’t yet surfing. At the same time, we’re paying attention to our environment, and watching for sharks in the water.

– Greg Stewart, CIO